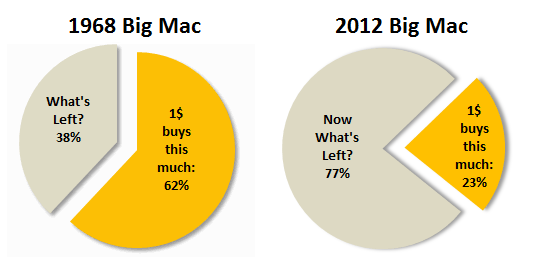

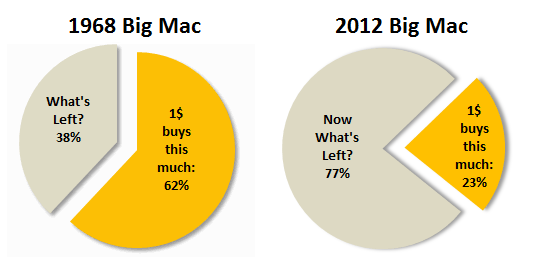

The current rate of inflation reported by CPI is 1.1%.However, Ed Easterling shows that the 10-year government bond rate should be about 1% above inflation. By printing money to buy bonds, the government has pushed the interest rate of a 10-year government bond down to about 1.70%. By understating inflation, the federal government is effectively reducing the amount owed to retirees and thereby cutting the long-term deficit.īig Mac Index Implications Related to Bond PricesĮd Easterling, founder of Crestmont Research, links inflation to the rate of interest rates. By using the consumer price index, the government is paying out $410 less than they would otherwise pay based on the rise in the price of a Big Mac…. In contrast, if the Big Mac Index were used, beneficiaries would be receiving $1,770. If an individual received $1,000 per month in 1999, they are receiving $1,360 today. This index is based on the Consumer Price index. Individuals on Social Security are provided a cost of living index. The reason for this is that it is believed people change their spending habits as prices change which is why the bureau of Labor Statistics instituted this policy.īig Mac Index Implications Related to Inflation

There is a “chained” effect meaning the basket of goods isn’t consistent from one time period to the next. CPI accounts for the substitution effect whereby if the price of beef increases, it is assumed that fewer people will buy beef and will instead buy chicken. However, there are two broad concerns with the CPI. The basket includes food & beverages, housing, apparel, transportation, medical care, recreation, education & communication, and other goods & services”. On the BLS’s website, CPI is defined as “a measure of the average change over time in the prices paid by consumers for a market basket of consumer goods and services. prices have accelerated much faster than the official reported Consumer Price Index (CPI) from the Bureau of Labor Statistics. rather than use the Big Mac index for comparing the value of currencies between countries, we… the price of the Big Mac within the U.S. each year since 1986 to see how it has change over time…. Using the Big Mac Index to Measure Inflation Because it contains beef, dairy (cheese), wheat (bun), cost of labor, and the cost of real estate, I believe it is a good representation of prices in the United States and abroad. It works by calculating the exchange rate that would leave a Big Mac costing the same in each country. The index is based on the theory of purchasing-power parity, which says that exchange rates should eventually adjust to make the price of a basket of goods the same in each country. The Big Mac Index basket contains just one item: the Big Mac hamburger. The Economist… created the Big Mac Index in 1986… was created to compare the price of currencies between different countries. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

There is a “chained” effect meaning the basket of goods isn’t consistent from one time period to the next. CPI accounts for the substitution effect whereby if the price of beef increases, it is assumed that fewer people will buy beef and will instead buy chicken. However, there are two broad concerns with the CPI. The basket includes food & beverages, housing, apparel, transportation, medical care, recreation, education & communication, and other goods & services”. On the BLS’s website, CPI is defined as “a measure of the average change over time in the prices paid by consumers for a market basket of consumer goods and services. prices have accelerated much faster than the official reported Consumer Price Index (CPI) from the Bureau of Labor Statistics. rather than use the Big Mac index for comparing the value of currencies between countries, we… the price of the Big Mac within the U.S. each year since 1986 to see how it has change over time…. Using the Big Mac Index to Measure Inflation Because it contains beef, dairy (cheese), wheat (bun), cost of labor, and the cost of real estate, I believe it is a good representation of prices in the United States and abroad. It works by calculating the exchange rate that would leave a Big Mac costing the same in each country. The index is based on the theory of purchasing-power parity, which says that exchange rates should eventually adjust to make the price of a basket of goods the same in each country. The Big Mac Index basket contains just one item: the Big Mac hamburger. The Economist… created the Big Mac Index in 1986… was created to compare the price of currencies between different countries. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. This article is presented compliments of Key to Making Money!) and may have been edited (), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read.

0 kommentar(er)

0 kommentar(er)